ENJOY AT YOUR OWN RISK.

You Have Been Warned, sort of.

Depending on if you own a timeshare or have vacation plan you are going to want to read this article. Timeshares and vacation plans can be the most dreadful, but exciting aspects to the American consumer vacation life. The resorts are amazing the fee’s are horrible, and there are so many scammers around you don’t know who to trust. Maybe at some point your own family start to feel like they work for the timeshare company themselves. Who know’s maybe little Sarah was recruited at the pool for front line timeshare sales. The information put together is from many sources such as the FTC, ARDA, Debt, local and state government agencies, but rest assure they are facts. Probably even wants to don;t want to read but you need to.

The thought of owning a vacation home may sound appealing, but the year-round responsibility — and expense — that come with it may not. Buying a timeshare or vacation plan may be an alternative. If you’re thinking about opting for a timeshare or vacation plan, the Federal Trade Commission (FTC), the nation’s consumer protection agency, says it’s a good idea to do some homework. If you’re not careful, you could end up having a hard time selling your timeshare or just getting out of one.

Many consumers are sold on the idea of using their money towards a timeshare instead of paying for hotels. The increased value, the same style of travel, the amazing amenities, and the ability to travel when, and where you want. This would seem to be the obvious reasons to jump right onto the timeshare wagon, and say no more hotels again for vacations. However, we must look at pure facts and see if this is the right decision.

What’s Included in Hotels?

Hotels are the traditional way for travelers to get lodging while they’re away from home. Most people will look them up first because that’s what they’ve done all their lives.

Hotels also offer a lot of amenities that are wrapped up in the overall cost of the room. Some of the more common ones are:

- Free breakfast

- Free Wi-Fi

- In-house gym

- Indoor or outdoor pool

- Room service

Then there are the luxury amenities to consider. There may be valet parking, room service credits and in-house restaurants with discounts for guests.

People want to get the most out of their money, which is what makes hotel amenities such an attractive offer.

What’s Included in Timeshares?

Timeshares give guests a guarantee they’ll love where they stay. By buying into a timeshare, people repeatedly visit a place they’ve already been.

People also love that timeshares offer housing amenities they’d otherwise be charged extra for at hotels. By staying in a timeshare, people can still use:

- A full kitchen

- A washer and dryer

- A living and dining room

- A private driveway

- Potential beachfront or lakefront access

Larger families or groups may lean more toward using timeshares because they can get a bigger space for less money than renting a large hotel suite for days or weeks at a time.

How Much Hotels Cost?

Cost is another major influence when it comes to deciding where guests are going to stay. Each person must factor in how long they’ll be vacationing and compare it to the price of accommodations.

Hotels cost an average of $260 per night in the U.S., and that’s just a standard hotel room. Rewards programs help balance this cost for some people, since the money they spend go toward points or they could redeem in the future.

Then there are luxury hotels to consider. If a guest wants to stay in a space that’s nicer than the average hotel room, it may cost $800-1,000 per night.

Luxury hotels can also have reward or membership programs. They may provide credit at in-house restaurants or free spa access. Guests have to consider if the benefits outweigh the overall cost of their stay.

These prices also depend on what time of year it is, as hotels have off-seasons, but guests can always count on spending money for each night they need a hotel.

How Much Timeshares Cost

Like with hotels, timeshares will cost guests differently depending on a variety of factors. While hotels rely on location, brand name and amenities to guide their prices, timeshares figure it all out upfront. To stay in a timeshare, people need to sign a deeded contract or lease that divides the property ownership between everyone. That makes it less expensive for people to have a vacation home.

Timeshare owners also have fees and maintenance costs to consider. The average timeshare is sold for $21,000 US. The average maintenance fee which comes yearly on most timeshare agreements is $1000. The timeshare loan is for 120 months (10 years) which is standard. Depending on what timeshare developer you are purchasing from, your credit score, and the dollar amount your interest will vary from 18%-30%. Many timeshare companies have resourced credit cards, and personal loan companies to assist on financing, and down payments.

There are also hundreds of timeshare refinance companies willing to lower your APR to as low as 3%. Keep in mind anytime you are using a company other than the timeshare company directly you are actually paying your timeshare contract off. You are now paid in full. There is no reversals, charge backs, upset and I am not paying you situation. You have now borrowed money from a legitimate bank, hard lender, consolidation loan company, or credit card company and said to pay off your timeshare. This later comes as horrible news to the timeshare owner seeking to get out of their timeshare contract.

FUN FACT:

$21,455—Average Price of a Timeshare Interval

Idiots Guide To Buying a Timeshare

There are two vacation ownership options available: timeshares and vacation interval plans. The value of these options is in their use as vacation destinations, never as investments. So many timeshares and vacation interval plans are available, the resale value of yours is likely to be a good deal lower than what you paid. In many cases less than the national minimum wage requirement. If you don’t believe us, view eBay one of the largest second hand dealers of everything. View Your Timeshare For Sale Online. Both a timeshare and a vacation interval plan require you to pay an initial purchase price and periodic maintenance fees. The initial purchase price may be paid all at once or over time; periodic maintenance fees are likely to increase every year.

Deeded Timeshare Ownership. In a timeshare, you either own your vacation unit for the rest of your life, for the number of years spelled out in your purchase contract, or until you sell it. Your interest is legally considered real property. You buy the right to use a specific unit at a specific time every year, and you may rent, sell, exchange, or bequeath your specific timeshare unit. You and the other timeshare owners collectively own the resort property.

Unless you’ve bought the timeshare outright for cash, you are responsible for paying the monthly mortgage. Regardless of how you bought the timeshare, you also are responsible for paying an annual maintenance fee; property taxes may be extra. Owners share in the use and upkeep of the units and of the common grounds of the resort property. A homeowners’ association usually handles management of the resort. Timeshare owners elect officers and control the expenses, the upkeep of the resort property, and the selection of the resort management company.

“Right to Use” Vacation Interval Option. In this option, a developer owns the resort, which is made up of condominiums or units. Each condo or unit is divided into “intervals” — either by weeks or the equivalent in points. You purchase the right to use an interval at the resort for a specific number of years — typically between 10 and 50 years. The interest you own is legally considered personal property. The specific unit you use at the resort may not be the same each year. In addition to the price for the right to use an interval, you pay an annual maintenance fee that is likely to increase each year.

Within the “right to use” option, several plans can affect your ability to use a unit:

- Fixed or Floating Time. In a fixed time option, you buy the unit for use during a specific week of the year. In a floating time option, you use the unit within a certain season of the year, reserving the time you want in advance; confirmation typically is provided on a first-come, first-served basis.

- Fractional Ownership. Rather than an annual week, you buy a large share of vacation ownership time, usually up to 26 weeks.

- Biennial Ownership. You use a resort unit every other year.

- Lockoff or Lockout. You occupy a portion of the unit and offer the remaining space for rental or exchange. These units typically have two to three bedrooms and baths.

- Points-Based Vacation Plans. You buy a certain number of points, and exchange them for the right to use an interval at one or more resorts. In a points-based vacation plan (sometimes called a vacation club), the number of points you need to use an interval varies according to the length of the stay, size of the unit, location of the resort, and when you want to use it.

You Need To Know This Before You Buy A Timeshare! DON’T

The total cost of a timeshare or vacation plan, includes the mortgage payments and expenses, like travel costs, annual maintenance fees and taxes, closing costs, broker commissions, and finance charges. Maintenance fees will increase at rates that equal or exceed inflation, so ask whether your plan has a fee cap. You must pay fees and taxes, regardless of whether you use the unit.

To help evaluate the purchase, compare these costs with the cost of renting similar accommodations with similar amenities in the same location for the same time period. If you find that buying a timeshare or vacation plan makes sense, comparison shopping is your next step.

- Evaluate the location and quality of the resort, as well as the availability of units. Visit the facilities and talk to current timeshare or vacation plan owners about their experiences. Local real estate agents also can be good sources of information. Check for complaints about the resort developer and management company with the state Attorney General and local consumer protection officials.

- Research the track record of the seller, developer, and management company before you buy. Ask for a copy of the current maintenance budget for the property. Investigate the policies on management, repair, and replacement furnishings, and timetables for promised services. You also can search online for complaints.

- Get a handle on all the obligations and benefits of the timeshare or vacation plan purchase. Is everything the salesperson promises written into the contract? If not, walk away from the sale.

- Don’t act on impulse or under pressure. Purchase incentives may be offered while you are touring or staying at a resort. While these bonuses may present a good value, the timing of a purchase is your decision. You have the right to get all promises and representations in writing, as well as a public offering statement and other relevant documents.

- Study the paperwork outside of the presentation environment and, if possible, ask someone who is knowledgeable about contracts and real estate to review it before you make a decision.

- Get the name and phone number of someone at the company who can answer your questions — before, during, and after the sales presentation, and after your purchase.

- Ask about your ability to cancel the contract, sometimes referred to as a “right of rescission.” Many states — and maybe your contract — give you a right of rescission, but the amount of time you have to cancel may vary. State law or your contract also may specify a “cooling-off period” — that is, how long you have to cancel the deal once you’ve signed the papers. If a right of rescission or a cooling-off period isn’t required by law, ask that it be included in your contract.

- If, for some reason, you decide to cancel the purchase — either through your contract or state law — do it in writing. Send your letter by certified mail, and ask for a return receipt so you can document what the seller received. Keep copies of your letter and any enclosures. You should receive a prompt refund of any money you paid, as provided by law.

- Use an escrow account if you’re buying an undeveloped property, and get a written commitment from the seller that the facilities will be finished as promised. That’s one way to help protect your contract rights if the developer defaults. Make sure your contract includes clauses for “non-disturbance” and “non-performance.” A non-disturbance clause ensures that you’ll be able to use your unit or interval if the developer or management firm goes bankrupt or defaults. A non-performance clause lets you keep your rights, even if your contract is bought by a third party. You may want to contact an attorney who can provide you with more information about these provisions.

Be wary of offers to buy timeshares or vacation plans in foreign countries. If you sign a contract outside the U.S. for a timeshare or vacation plan in another country, you are not protected by U.S. laws.

FUN FACT:

$10.2 Billion—Size of the Industry

- 1,580 timeshare resorts in the U.S., 204,100 units – 129 units per resort on average

- Comparable to the $9 billion in revenue for Major League Baseball and the $8 billion music industry

Timeshare Exchange Systems

An exchange allows a timeshare or vacation plan owner to trade units with another owner who has an equivalent unit at an affiliated resort within the system. Here’s how it works: A resort developer has a relationship with an exchange company, which administers the service for owners at the resort. Owners become members of the exchange system when they buy their timeshare or vacation plan. At most resorts, the developer pays for each new member’s first year of membership in the exchange company, but members pay the exchange company directly after that.

To participate, a member must deposit a unit into the exchange company’s inventory of weeks available for exchange. When a member takes a week from the inventory, the exchange company charges a fee.

In a points-based exchange system, the interval is automatically put into the inventory system for a specified period when the member joins. Point values are assigned to units based on length of stay, location, unit size, and seasonality. Members who have enough points to secure the vacation accommodations they want can reserve them on a space-available basis. Members who don’t have enough points may want to investigate programs that allow banking of prior-year points, advancing points, or even “renting” extra points to make up differences.

Whether the exchange system works satisfactorily for owners is another issue to look into before buying. Keep in mind that you will pay all fees and taxes in an exchange program whether you use your unit or someone else’s.

FUN FACT:

9.6 Million—Number of U.S. Households That Own 1 or More Types of Product(timeshare weeks, points, fractional and/or Private Residence Club)

- 64% are married

- Average age of an owner is 44 years old

- 11% of timeshare owners earn $100K or more

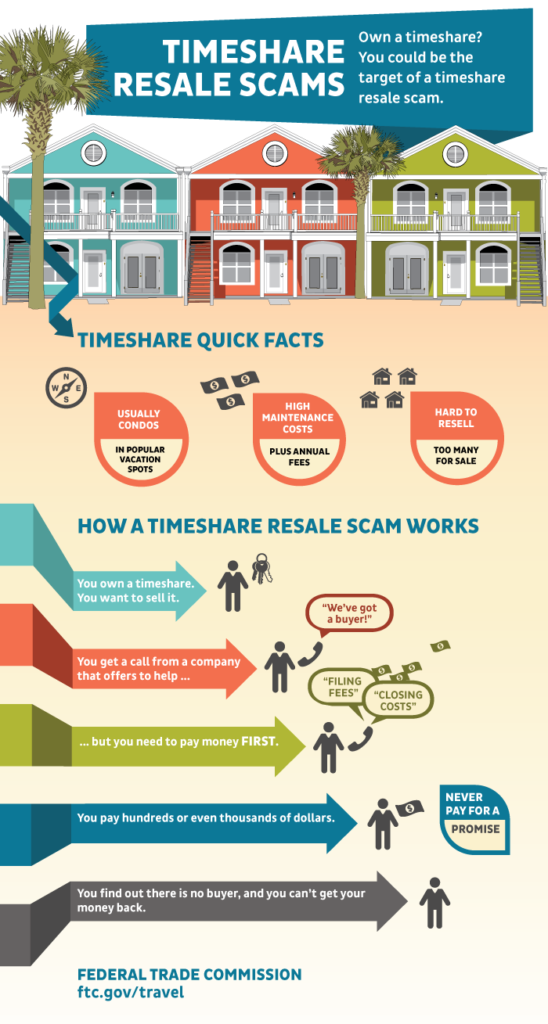

Selling a Timeshare Through a Reseller? “Watch Out Now, Not Many Of Legit Ones”

If you’re thinking of selling a timeshare, the FTC cautions you to question resellers — real estate brokers and agents who specialize in reselling timeshares. They may claim that the market in your area is “hot” and that they’re overwhelmed with buyer requests. Some may even say that they have buyers ready to purchase your timeshare, or promise to sell your timeshare within a specific time.

If you want to sell your deeded timeshare, and a company approaches you offering to resell your timeshare, go into skeptic mode:

- Don’t agree to anything on the phone or online until you’ve had a chance to check out the reseller. Contact the state Attorney General and local consumer protection agencies in the state where the reseller is located. Ask if any complaints are on file. You also can search online for complaints.

- Ask the salesperson for all information in writing.

- Ask if the reseller’s agents are licensed to sell real estate where your timeshare is located. If so, verify it with the state Real Estate Commission. Deal only with licensed real estate brokers and agents, and ask for references from satisfied clients.

- Ask how the reseller will advertise and promote the timeshare unit. Will you get progress reports? How often?

- Ask about fees and timing. It’s preferable to do business with a reseller that takes its fee after the timeshare is sold. If you must pay a fee in advance, ask about refunds. Get refund policies and promises in writing.

- Don’t assume you’ll recoup your purchase price for your timeshare, especially if you’ve owned it for less than five years and the location is less than well-known.

If you want an idea of the value of a timeshare that you’re interested in buying or selling, consider using a timeshare appraisal service. The appraiser should be licensed in the state where the service is located. Check with the state to see if the license is current.

Read The Contract The Whole Contract So Help You Timeshare Fraud.

Before you sign a contract with a reseller, get the details of the terms and conditions of the contract. It should include the services the reseller will perform; the fees, commissions, and other costs you must pay and when; whether you can rent or sell the timeshare on your own at the same time the reseller is trying to sell your unit; the length or term of the contract to sell your timeshare; and who is responsible for documenting and closing the sale.

If the deal isn’t what you expected or wanted, don’t sign the contract. Negotiate changes or find another reseller.

FUN FACT:

12.1 Million—Number of Nights Rented at Timeshare Resorts

- 84% of timeshare resorts offer some type of rental program.

- Reflects $2.4 billion in revenue

The Checklist To Disappointment

Selling a timeshare is a lot like selling any other piece of real estate. But you also should check with the resort to determine restrictions, limits, or fees that could affect your ability to resell or transfer ownership. Then, make sure that your paperwork is in order. You’ll need:

- the name, address, and phone number of the resort

- the deed and the contract or membership agreement

- the financing agreement, if you’re still paying for the property

- information to identify your interest or membership

- the exchange company affiliation

- the amount and due date of your maintenance fee

- the amount of real estate taxes, if billed separately

Well What Are My Options?

Well after reading this article about your resale options you are most likely not going that route. You are still in the predicament of the increasing timeshare bill, and assessment costs which show up every year. At this point you may have used it once or twice, but there is no future plan to go back in fear of another “Owners Meeting” which you dread every time. Your personal relationship with your spouse is at its limits when anything is spoken of this darn timeshare. So what are we going to do?

The options You Decide:

- You Keep It; then I am not sure why you are reading this article. If this is an options start at the beginning again.

- You Sell It; Well if you have been reading this article this is probably not the option you are choosing. If so, please reread the article, slower.

- Stop paying for it and walk away. Do this step at your own risk, credit, debt collectors, and lawyers may be contacting you.

- Cancellation Advocacy; Direct disputes and negotiations sent to the timeshare resort to cancel, settle, or close the timeshare agreement. Timeshare cancellation can also be known as negotiation for timeshare release, mediation of timeshare contract relief, and timeshare relief consulting.

Fun Fact:

$7.2 Billion—Amount Spent by Timeshare Owners & Guests during Timeshare Stays

- Approx. $2.88 billion spent onsite at resorts.

- $4.35 billion was spent off-site in the communities where the timeshare resorts are located.

I’ve Stopped Paying Now What?

If you have stopped paying or about to stop paying please make sure there is a credit management, or debt negotiation company/team to review the situation and counsel you to reduce imminent damage to your consumer reports which may have already happened or is about to happen.. It is not the end of the world, but you should never neglect your creditors, or avoid them unless under specific direct for law enforcement, or your attorney.. Many timeshare relief companies will not assist you in anything “Credit”, or “Debt” related. This is in fear of the government slapping fines, and then having to adhere to regulations.

Cancelling a timeshare contract is a process that most responsible Americans have never experienced. They are either stuck in a situation of affordability, or they have come to find out the value of their purchase. The timeshare company will not help them get out of it, and the supply and demand are so out off balance you cannot give away your timeshare. The timeshare industry has expanded to $10.2 billion dollars of activity and they are not slowing down. Be careful of the 100% promises, the money back guarantee’s, and the you won’t feel a thing statements. They just are not true. Remember ask questions, review your options, and its OK to think about it. Anyone stating you need to do it now, or has to be today equals you getting scammed.